If you’ve ever applied for a loan (or wanted to apply), you’ll know that it can be an intimidating and confusing process. Often times you’re expected to hand over personal information, such as your social security number, without really understanding what will be done with it. If you want to receive multiple loan offers before deciding which one to go with (which is a smart financial decision), you may need to do this multiple times. And it can take weeks or even months to hear back from a bank or lender, which is extremely frustrating. Enter Magilla.

What is Magilla?

Simply put, it’s a free website that allows visitors to anonymously compare loan offers. (Just in case you were wondering, it’s in no way related to the cartoon Magilla Gorilla). It was created by borrowers who were frustrated with the traditional loan comparison process. Magilla’s goal is to give the consumer a little more control when trying to get a loan; in fact, they claim on their website, “No Personal Information, No Phone Calls… You are In Control.” Sounds good so far!

How does it Work?

How is a website able to show loan offers without collecting personal information? After a visitor completes the application, which asks generic questions such as the type of loan you’re looking for and the rate type preferred, lenders will then have ten days to respond. You can then choose whether or not you will want to work with one of the lenders, at which time you will need to provide personal information to the lender. Up until that point, however, you can compare your loan offers anonymously. The website is free to use, with no hidden fees, making it a valuable comparison tool. Lenders can sign up with them in order to respond to borrowers’ queries, and ten of Magilla’s current partners include Bank of America, Caliber Home Loans, US Bank, Bank of England, C&B Trust, Wells Fargo, Banner Bank, Chase Bank, BB&T, and Regions.

The Process

I wanted to try Magilla’s loan comparison service for myself. The questionnaire was easy to use, and while it did ask for information such as the purchase price of the house and an estimated credit score range, it does not ask for identifying information such as a name, phone number, or social security number. It does ask for an email address, which they will use to contact you about new loan offers and which you can use to log back in to the system. If you wish, you can also provide a phone number to receive text notifications, although Magilla will not give your phone number to any prospective lenders. Overall, the registration process was easy to complete and very simple. There was even a progress bar to let me know how much left I still had to do. Once I was finished with the questionnaire, I was officially registered with Magilla, and after a few minutes, I received an email to activate my account.

First Impressions

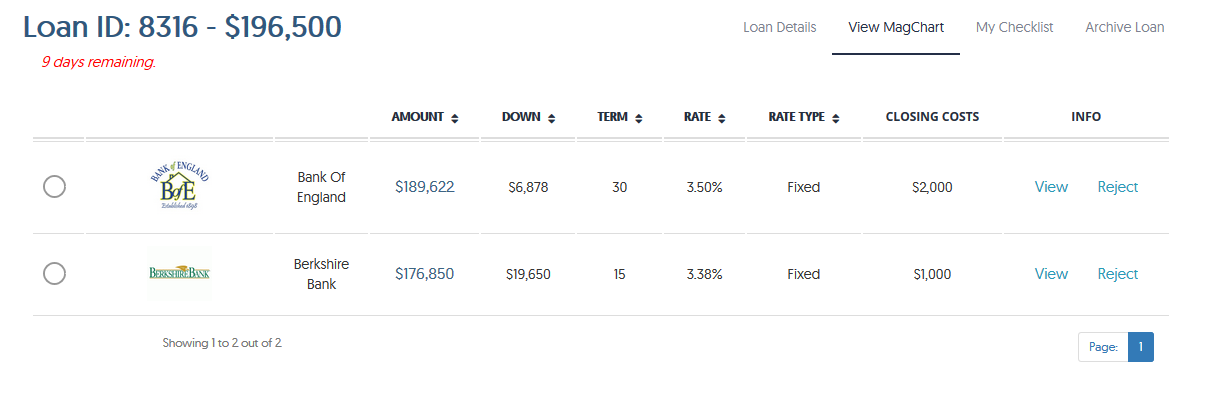

When I first logged on to my new Magilla account, I was brought to a chart that would later hold my loan offers. It had places for Bank Name, Loan Amount, Down Payment, Term, Rate, Rate Type, and Closing Costs. There was also a countdown listed in red above the chart, which showed how many more days lenders had to respond to my query. At this point, there was nothing more I could do but wait.

Loan Offers

Less than 24 hours later, I already had two loan offers: one from Berkshire Bank and one from Bank of England. I received an email notification informing me of the activity on my Magilla account, and when I logged on, I was able to re-arrange the loans in the chart by the various categories. For example, I could choose to view the ones with the lowest down payment first, or the shortest term, or the highest loan amount. I was also able to view each loan offer separately, including a message that the lender prepared with the loan offer. After the first day alone, it’s easy to see the appeal of being able to view potential loan offers before making any type of commitment. I could simply choose to continue working with the lender that offered me the best loan.

The following day, I received an additional loan offer from Bank of England, but with different terms. Although I continued to check my account for the next ten days, I received no additional offers.

Next Steps

After the ten days had passed, the countdown timer above the chart started to go back up again. I was confused about this at first, but then I figured out it showed how many days had passed since the end of the lender deadline. Even though I waited the full ten days, at any point I could have contacted one of the lenders about their offer. (And Magilla states on its website that borrowers tend to go with lenders who respond quickly, providing another incentive for lenders to provide a loan option as soon as possible.) True to its word, Magilla was able to help me freely compare several loan options all while remaining anonymous.

Other Features

I primarily focused on the loan comparison feature, but Magilla has other services available, including MagChat™ and a discipline and vendor checklist. MagChat™ is an online chat service that enables potential borrowers to anonymously talk to lenders in order to ask questions and clarify their request. The checklist, which can be found on the website, lists vendors and information for those interested in solar energy, credit repair, and debt consolidation.

Final Thoughts

Overall I was impressed with Magilla. I received three offers from two banks in less than two days, which I was able to compare anonymously. For a process that is usually thought of as taking months, it was surprisingly quick and simple. While it still would be a good idea to do some more research before choosing a lender, Magilla is a great place to start.