ZIP-a-Dee-Doo-Dah

(Click here for the original song version!)

There was recently an article in Forbes regarding the most expensive “zip codes” in America. The prices stated were “median” costs. That means half of the values fell below the listed amount and the other half were ABOVE it. Oh my. As such, there were numerous entries for zip codes in the New York City area, in and around Hollywood, Silicon Valley, Miami and the Hamptons.

I’ve been to a house wedding in Atherton, California, #3 on the list. It was certainly a beautiful property, but I couldn’t help arrogantly thinking it wasn’t worth the (probably) $7 Million price tag that accompanied it, ha. We jealous people can dismiss, minimize or rationalize almost anything.

But the number ONE, most expensive zip code in the US according to this Forbes article, at a Median Price of $7,859,998, is listed as Manalapan, Florida. That’s zip code 33462. And, by the way, according to the town website, the 2010 census showed a population of just about 400, with a seasonal swell to nearly 550.

While possibly fascinating, that’s not the point of today’s blog. The point is--who gives the MORTGAGES for the homes in these top zip codes, and at what terms?

I hear you. If you can afford a $7 million home, you don’t need home financing. And while that is almost definitely the case for most, what of those outliers who want the tax write off still allowed for mortgage interest paid? How about the nouveau riche who may now have the income to support such a property but not the cash to purchase it? What about Bunky, son of Winston III, who inherited the property but wants cash from it to purchase a race car, yacht, small town in the Ozarks …? Do these folks wander into their small local bank branch and complete a 1003 application for eighty percent of $7 Million?

Probably not exactly. For example, most people in that moneyed stratosphere have financial advisors. Those financial advisors have divisions, contacts, and/or partners who provide their higher end clients home loans. For example, Morgan Stanley has “Morgan Stanley Home Loan Solutions.” The PNC Bank Wealth Management division has a “Lending Arm” (that offers Personal Bankers to assist with all kinds of mortgages, in addition to ARMs … tee hee).

I remember my saddest early day when I started in the mortgage business a few decades ago. I got a call from a potential client in Bergen County, New Jersey, who was seeking a $5 million home loan. In those days, anything over $3 million was considered “commercial financing” and we were unable to assist this client directly. All I could do was refer the caller to an acquaintance who “knew a guy” who would handle this gigantic loan. Before I had even calculated the commission on such a loan ($30,000 at a mere 60 basis points!), it was gone.

As loan limits, property values, and loss of reasoning and logic grew (kidding about that last one, I think), lenders sort of, kind of still use that $3,000,000 amount as the maximum. However, today most can make exceptions, on a case by case basis, for exceptional borrowers who are buying or refinancing incredible properties with appropriate and documented value and who usually have some sort of secure asset base with the lender. Whew! It's all back to that old Bob Hope joke that states, “A bank is a place that will lend you money if you can prove that you don't need it.”

Let’s work through an example of how much money is not needed here. I completed a search for zip code 10075 in New York City, which came in second in the aforementioned Forbes listing. I next chose a $30,000,000 townhouse on East 77th Street. Suppose the buyer of this property choose to put down a massive 50% (or $15,000,000). That yields a monthly payment (at 4.25%) of $73,791. The 2015 annual US median household income per the census bureau is $53,889. So sorry most of America, this NY City Townhouse is just not for you, ha.

Remember that mortgage lenders obviously want your monthly income to be much MORE than your monthly mortgage payment. Let’s use 30% in this case; in other words, your mortgage payment will be 30% of your monthly income. That means that your monthly income in this case must be $245,970. Yes then, your annual income must be a mere $2,951,640. Oh sorry, I left out monthly maintenance (taxes, insurance, doorman fees, etc.). Let’s just say that if you conservatively make at least $3,000,000 or more and have a spare $15,000,000 to use as a down payment and have good credit and all the other lender requirements, you can buy this townhouse in zip code 10075 in the heart of New York City! Congratulations!

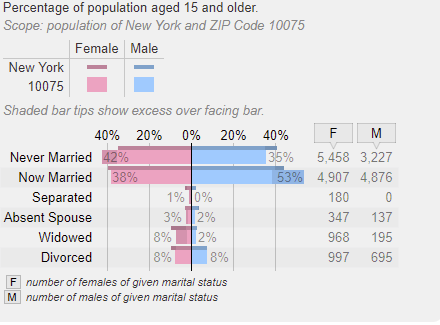

Naturally, I was curious to see who these eligible people are. Who lives and owns in zip code 10075? Statistical Atlas gives us so much information. I won’t bore you too much with what is of great interest to me (numbers). But there were just a few noteworthy items I must include here. For example,

42% of the 10075 population is composed of “Never Married” Females! So, okay, it starts that category at age 15, but still! Interesting …

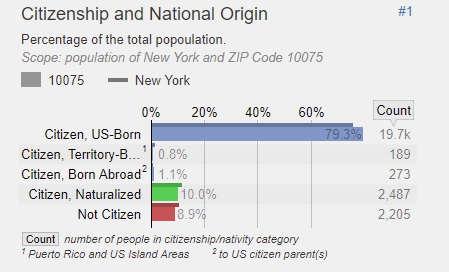

In constructing this blog, I called a cynical NY friend who has retired from the mortgage business. When I asked who he thought bought homes in this zip code, he told me it was mainly “Foreign Nationals” who paid cash. Well, perhaps, but that’s not who is living there.

It appears the top category in zip code 10075 (or 79.3%) is “Citizen, US-BORN.” Hmmm. Perhaps those Foreign National borrowers purchased the homes and then gave them to deserving US-Born citizens? (Just kidding, Bill!) And since I previously taught a class called “Lying with Statistics,” I can feel free to skew this data any way I see fit, ha.

Why else would anyone want to live in zip code 10075? Let’s see -- there are fabulous restaurants. The nightlife is excellent. There is great shopping and many entertainment choices. The transit system is, per Trulia, “... clean, reliable and affordable.” That same site noted, “The average listing price in ZIP code 10075, once $3,137,076 in last year, is $4,857,819 this year, a very impressive 54.9 percent increase.”

One may be reminded of yet another quote, this one by John Updike: “The true New Yorker secretly believes that people living anywhere else have to be, in some sense, kidding.”

Ready for some more kidding? Keep the cheering to a minimum and forge ahead.

Can I borrow that book of yours How To Become A Millionaire? Sure. Here you are. Thanks – but half the pages are missing. What’s the matter? Isn’t half a million enough for you?

What do you get if you cross a sorceress with a millionaire? A very witch person.

After years of scrimping and saving, a husband told his wife the good news: “Honey, we’ve finally got enough money to buy what we started saving for in 1989.” “You mean a brand-new Mercedes?” she asked eagerly. “No,” said the husband, “a 1989 Mercedes.”

Why is money called dough? Because we all knead it.

After hearing a sermon about lies and deceit, a man wrote the IRS, “I can’t sleep knowing that I have cheated on my income tax. Enclosed is a check for $1000. If I still can’t sleep, I’ll send the rest.”

Three animals were having a drink in a cafe, when the bartender asked for the money. “I’m not paying,” said the duck. “I’ve only got one bill and I’m not breaking it.”

“I’ve spent my last buck,” said the deer.

The skunk said, “Getting here cost me my last scent.”

[Okay, okay, I’ll stop now!]