There are obvious advantages to self-employment, not least of which is being your own boss - you can set your own schedule, determine your own workload, and hopefully make more money. But there are many factors that you should consider before you opt for self-employment. Here are a few to considering if you're wondering whether self-employment might be right for you:

1. You must be self-motivated. If you're not self-motivated, work won't get done, and money won't come in. So above all, you must be certain that you will work at least as hard for yourself - if not harder - than you do for your current employer.

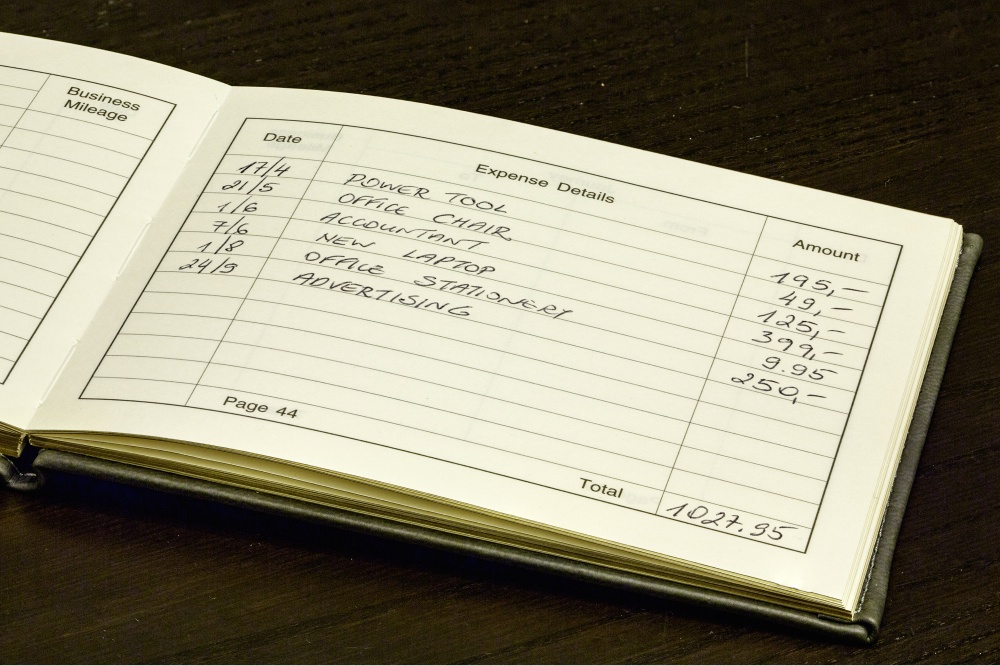

2. Start-up costs might be high. Some small businesses have little to no start-up costs, while other businesses have significant start-up costs. Depending on the type of business you're starting, you may need to purchase equipment and licenses, hire personnel, rent space and more. If you are going to need start-up capital, be sure to plan for that.

3. There may be legal hoops to jump through. Various types of businesses are regulated by different government agencies, so depending on the type of business you start, you may need to obtain a license, purchase insurance, file certain paperwork with a certain agency, and so on. Before starting your new business, you should research any legal requirements and be confident that you can satisfy them.

4. Taxes can be complicated. Self-employed people often pay more taxes, not less. Additionally, your business and personal tax returns may become very complicated. Prior to setting up your business, you may want to consult an accountant, who can advise you on the optimal structure (e.g., S Corp, LLC, sole proprietorship, or other), what tax forms you will need to file, and how to minimize your tax liability.

5. Your income will be irregular. The first tenet of basic personal finance is create a budget and stick to it. But that is extremely difficult to do when you can't predict how much money will be coming in each week, month or even year. The best thing you can do to hedge your bets is to save a substantial sum for your personal expenses before you start your business - you can then tap into your savings as needed while your business is getting off the ground. You should also take care of any transactions that may require proof of steady income, such as buying real estate, while you are a W-2 employee. Many, if not most, lenders will refuse to fund a loan for someone with a brief self-employment history.

6. You're solely responsible for your health insurance, retirement funding, and more. When you work for someone else, your employer likely provides health insurance, contributes to Social Security and Medicare on your behalf, and often contributes to your 401(k) as well. Once you are self-employed, you'll have to obtain your own health insurance, and set aside your own retirement funds (as well as pay your own Social Security taxes). Don't forget to include these considerations when you are deciding whether you can afford to be self-employed.

Being self-employed has advantages and disadvantages. You have the potential for pursuit of passion, unlimited income, freedom of time, and more. But there is also substantial risk, so you'll have to carefully weigh if that potential is worth risking a steady paycheck and having the rest of your time available to pursue other interests without worrying about bringing in enough income.