-

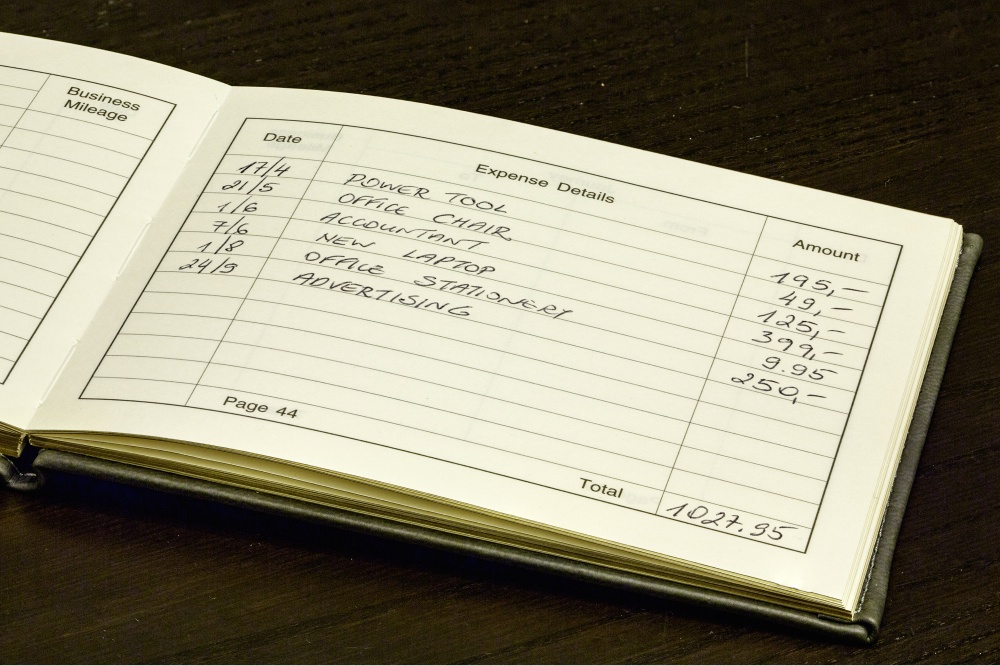

There are obvious advantages to self-employment, not least of which is being your own boss – you can set your own schedule, determine your own workload, and hopefully make more money. But there are many factors that you should consider … Continue Reading

-

A living trust is an estate planning document used to distribute property upon death while avoiding probate court. It is called a “living” trust because it is created while the property owner is alive, rather than upon his or her … Continue Reading

-

State law generally provides that your property will be passed to your heirs – usually your spouse, children, grandchildren, and parents. The laws involved in estate planning – known as “intestacy” laws – can be complicated, and vary from state … Continue Reading

-

For many people, buying a new car automatically means a new car loan. But it doesn’t have to. There are lots of other folks who pay cash for a used car, lease a car for smaller monthly payments, or even … Continue Reading

-

Most people – even financially savvy ones – have a hard time determining the details of their financial plan. Which stocks or mutual funds are right for their portfolio? How much cash should they have? How much do they need … Continue Reading

-

April 15 – “Tax Time” – is rapidly approaching, and there are a few things you can do to help yourself this year: 1. Invest in an IRA – You have until April 15 to max out your IRA investment … Continue Reading

-

These days, it seems like we’re always getting a new credit or debit card in the mail. It’s easy to activate a new card and stick it in your wallet. But what do you do with the old card? You … Continue Reading