Where Oh Where Oh Where*

* The link is correlated to pretty much nothing. I just always wondered

who cuts a dog’s ears … yes, I started with a digression.

Recently, some friends were discussing where they eventually wanted to retire. That included a best case/worst case barometer involving available funds, location of living family and friends, etc. In other words, Delaware for no income taxes or France for the wine … like that. 🙂

So, not that I am close to wanting to retire (... and miss all the workplace fun? No way!), but I started a research quest. Little did I know where that quest would take me.

A Mortgage Retirement?

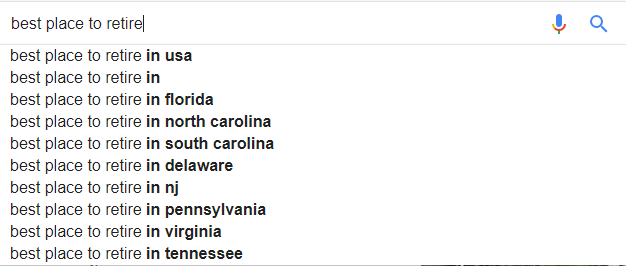

If you simply ask our friend Google about the best place to retire, the search bar will self complete with the states…

Obviously, then, its looking for more words after “retire.” Therefore, since this is a mortgage blog, I tried that first. Under the category of. “Why not?,” I searched, “Best place to retire and get a mortgage.” Yes, I agree, that makes little sense, but …

I did find this:

How to Get a Mortgage Once You Are Retired - The Balance Shockingly (excuse the sarcasm), the how to here is the same how to as getting a mortgage while still working -- verifying income, assets, debt, credit, etc. It also includes a brief discussion of the pros and cons of having a mortgage at all, after retirement. The conclusion was, “don’t.”

But the NY Times gives a slightly different perspective in, “Mortgages for Seniors? Available, but Exacting.” Here’s their premise,

“An increasing number of older Americans prefer to have a mortgage. They may have the means to buy with cash but choose instead to take advantage of prevailing low interest rates and tax breaks, while freeing up their savings for other uses.”

Seniors are still working, perhaps more financially savvy than previous generations, but sometimes not prepared for the new and more arduous mortgage process.

So don't mistake hefty retirement funds with no mortgages. “Thinking Beyond Numbers: Changing the Way the World Thinks About Money” asked three personal finance authors about millionaires’ mortgage habits. One author opined 60% of millionaires have a mortgage that represents 7% of the outstanding principal balance. The second writer urges moneyed people to get a 30 year fixed rate loan and pay it biweekly to save lots of money and pay off the loan completely in 22 years. The third stresses the need to live debt free -- period. But at least we now know where to live with that mortgage or without it.

How, What, Where and Why

This blog, however, is not just about the “how” but also about the where and why … and the digressions. Let’s digress again and have some fun with that.

Ask yourself what are the things in your life that are most important to you. Normally, that list includes, “Health, Family, and XXXX.” We want to guess that XXX and offer the perfect place to meet your needs in retirement, you crazy guy or gal. For example, suppose you are single, have limited income, and want to retire abroad. Check out:

Which country would best suit a single person retiring on $2000 a month? What??? Yes, that can happen in Costa Rica, Cuenca, Ecuador, Italy, France, Spain, Croatia, Nicaragua, Mexico, the Caribbean island of Roatan, Thailand, Panama, Brazil … who knew? However, suppose you'd prefer to buy and finance a property abroad? Forget about securing the mortgage as mentioned earlier. The steps might just be a little different (okay, strike out “might be”).

In, “A guide to Spanish mortgages” for example, I love the “golden visa” idea:

“As a result of stagnant domestic demand, like many of its EU peer countries, the Spanish government is eager to welcome foreign investment in its real estate market. Under certain conditions – including a minimum investment level which can be spread among several properties – investors can receive a Spanish residency permit.

The so-called ‘golden visa’ allows qualifying individuals to reside in Spain and travel throughout the EU, though it does not allow for work or grant access to state benefits. Golden visas require an investment of at least €500,000 [about $425662.33] (without financing). Procedures for obtaining a Spanish golden visa can be obtained from a Spanish consulate in your current territory.”

But if you just want to go to Spain, buy a house, and get a mortgage, then you may be able to get up to 80% of, well, something. It might be 80% of the bank’s assessment of the property OR it might be 80% of the purchase price OR it might be the lower of those two. If overseas retirement living with an owned property is your goal, do LOTS of checking before moving forward.

Retiring with Fido

Back to Google Query Fun … Maybe you’d like to stay in the good ole U S of A and want to go the best place for your dog (hey, stranger things have happened! And, we’ve talked about this before here). Let’s add to that.

In, “The Most Dog-Friendly Cities in America in 2017”, we’re given this:

How in the world was this determined? The factors involved were: dog parks and dog-friendly restaurants and stores; cities’ walkability and home values (apparently, higher is better for dogs?).

But, don’t worry. There is also, “30 Best Small Towns for Dog Lovers.” Considered in this rating were: towns with populations with less than 80,000 people, the number of pooch-friendly restaurants and businesses, local places to walk and play, and listed accessible canine health professionals.

In terms of financing a palace for Prince the Pet, not to worry. There are loads of query-able helpful resources and data sources available including:

Suppose you and Fido, or you and spouse, or just you have that pretty million dollar nest egg. Surely, there are places suitable just for you, right? You bet.

In, “11 Cities Where $1 Million In Retirement Lasts The Longest” Forbes’s apparently-hunky-writer Andrew DePietro (oops, sorry, I digressed again there a tad, didn’t I?) reported on GOBankingRates’ analysis of annual expenditures for someone 65 or older, including housing, transportation, utilities, healthcare, groceries and miscellaneous costs. Sadly, Houston, Oklahoma City, Austin, Tulsa, Memphis, Columbus, Indianapolis, Louisville, Omaha, San Antonio, and Nashville residents save money by NOT owning dogs, as they were not on the previous bow wow list.

Feeling selfish, (which reminds me of the old joke, “Why don’t oysters give to charity? Because they're shellfish!), I next Googled, Best places for Bloggers to retire. While nothing directly related appeared, I apparently need to speak with my editors! (JOKE!!). Check out:

How to Make $5,000 a Month With Freelance Blog Writing

I digress … again.

Retirement for Veterans

What about the truly important -- our Veterans (and thank you for your service)? In 10, “Best States for Military Retirees: 2018,” there are noted differences to remember.

Military benefits are taxed differently, some job markets may glamor for vets where others shun them, and nets may be disabled. Then there is the new “blended” military retirement some have chosen which goes from a specific benefit to a blended retirement system, which awards money based on years of service and matches contributions to a thrift savings plan, both.

The best vet states were determined to be 1) Florida, 2) Virginia, 3) New Hampshire, 4) Alabama, 5) South Carolina, 6) Maine, 7) South Dakota, 8) Alaska, 9) Idaho, and 10) Texas. And I know some experts VA Loan Offices in nearly all of those markets!

Why did the car stop working? It wanted to re-tire!

How does one really best decide where to retire? Forbes say to ignore the ‘best places’ lists and, instead, ask yourself these questions:

“Do you want to be near friends and family?

Will you be taking care of aging parents? If yes, will you need to be close by?

Do you have hobbies or interests that play into where you’d want to live?

Will you work during retirement? If so, will the location matter to you? (If you’ll transition to a part-time schedule for your current job, you may need to retire near or exactly where you live now.”

Sadly, there was nothing about French wine mentioned.

Now let’s steal from ONELINEFUN:

The question isn't at what age I want to retire, it's at what income.

The best time to start thinking about your retirement is before the boss does.

Retirement is the time in your life when time is no longer money.

Be nice to your kids. They'll choose your nursing home.

Somewhere an elderly lady reads a book on how to use the internet, while a young boy googles "how to read a book."

Retirement is wonderful. It's doing nothing without worrying about getting caught at it.

How do you know you’re old? People call at 9 p.m. and ask, "Did I wake you?"

My grandfather tried to warn them about the Titanic. He screamed and shouted about the iceberg and how the ship was going to sink, but all they did was throw him out of the theater.

Do you realize that in about 40 years, we'll have thousands of old ladies running around with tattoos?

Age is an issue of mind over matter. If you don't mind, it doesn't matter.