Is SoFi -- a lender that offers student loan refinancing, mortgage, and other financing programs -- an up and coming fintech company or one that will surely provide disruptive innovation to the mortgage industry? Or is it a bit of both?

Background:

SoFi is an online “marketplace lender” that is attempting to transform financial services. It was the first company to enable post-secondary graduates to consolidate and refinance their student loans.

Since then, SoFi has expanded its offerings to include mortgages, mortgage refinancing, and unsecured personal loans. SoFi expects to exceed $6 billion in funded loans from all products by the end of 2015.

SoFi is located in San Francisco, California, and also has offices in Healdsburg, California; Helena, Montana; Frisco, Texas and the Washington, DC area with licenses to conduct business in several additional states.

SoFi (short for Social Finance) is definitely not the plural of sofa.

Examining what SoFi does for the mortgage industry, at first glance and according to its website, it offers:

· Unique products which may have lower rates and flexible terms

· A simple online application with customer support offered 7 days per week

· No application fees

· And “member benefits”

At least the latter certainly seems disruptive compared to the rest of the mortgage industry. Here are just a few of the overt pros and cons of SoFi as they relate to mortgages.

UPDATE: WATCH SOFI's 2016 SUPERBOWL COMMERCIAL:

Pros:

"Unicorn" Funding

Maria Aspan on Inc.com, says, “In four short years his online lending startup, SoFi, has gone from inception to a current valuation "not too far off" from $4 billion -- yes, with a "b." Last month, Japan's SoftBank and other investors cut SoFi a check for $1 billion in series E funding, which the companies called the largest equity round for a financial technology startup. (To trot out the mythical creature analogy, Cagney's investors went beyond turning SoFi into a unicorn; you could say they gave him one instead.)”

Thornton McEnery notes in the DealMaker article “Fintech Startup SoFi Raising Funding At An “ALL The Money” Valuation” that “Sure, Unicorns are adorable and hip these days, but why see yourself as a middling tech startup valued in the single digit billions when you can aim even higher?”

And on December 1, 2015, Jonathan Marino wrote in Business Insider that “The CEO of the world's hottest fintech startup [SoFi] is targeting a $30 billion valuation”

Talented Top Management Team

In Inc.com’s article “5 Reasons I Invested in SoFi” by Brian Cohan, he sites reason #2 as: “When I considered SoFi, I was pleased that its CEO, Mike Cagney, had extensive industry experience--having worked as a head trader at Wells Fargo and was smart--holding a graduate degree from Stanford Business School. Moreover, he had attracted top talent--SoFi's Chief Operating Officer was previously CEO of KKR Financial and Treasurer of Wells Fargo.”

The company was founded by Mike Cagney, Dan Macklin, James Finnigan and Ian Brady -- four students who met at the Stanford Graduate School of Business.

“[SoFi’s] growth attracted the attention of Arthur Levitt, the longest-serving chairman of the U.S. Securities and Exchange Commission and current advisor to private equity giant Carlyle Group. Levitt joined SoFi as an advisor in September.” READ MORE

Innovative, Fast, Simple Mortgage Loan Approval Technology

SoFi relies more on cash flow than DTI and uses a proprietary set of metrics and algorithms to assess credit quality. Their underwriting approach takes into consideration parameters not generally measured by banks. SoFi can pre-approve mortgage borrowers via a mobile app in minutes.

The NY Times quotes borrowers Jeff and Zizi Patmont as saying, ““We were able to get a 15-day close, which helped us, because the competing offer couldn’t close that quickly.”

This focus on speed and technology is especially appealing to Millennials.

“SoFi's proprietary underwriting approach takes into account an applicant's ability to repay and employment history to offer unique credit products that consumers won't find elsewhere.” From www.regulations.gov

Unique Products

The statement “Dream Big. Pay Little. Afford more than you imagined with as little as 10% down on mortgages up to $3M” appears directly on the SoFi website. This is, indeed, unique in this market. David Weliver of moneyunder30.com states that SoFi also offers: 10 percent down payment options with no PMI; flexible debt-to-income limits; no restrictions for first-time homebuyers. And all of this is accomplished with no application, origination, or other lender fees.

CEO Mike Cagney has been known to hunt for products that reduce barriers for their clients.

Cons:

Lack of National Licensing and Visible Locations

At the time of this writing, SoFi is licensed to close mortgage loans in only 23 states. If you choose to refinance your home loan or obtain a mortgage for a new home in any of the 27 other states, you will be unable to use the services of SoFi today.

That can also mean that if you are in California (one of the states in which they are licensed), and obtained a SoFi home loan but then moved to New York (where they are not currently licensed), they would be unable to handle your new home loan there.

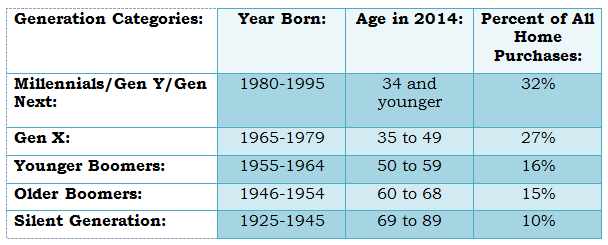

Sofi currently has only a handful of physical offices outside its corporate headquarters in San Francisco. This may not appeal to a large percentage of home buyers – namely Baby Boomers – who may still prefer to see people with whom they discuss major financial transactions such as mortgages. Amanda Riggs cited in an article for the NAR that 32% of all home purchases in 2014 were by Millennials, Gen Y or Gen Next, but 31% were by Younger and Older “Boomers”.

2015 Home Buyer and Seller Generational Trends Report

According to a study completed by Synchrony Financial, Boomers still have the most disposable income and Boomers crave customer service … They may perceive that a primarily online “mortgage company” is not appealing.

Untested Mortgage Longevity Performance

SoFi entered the mortgage arena in late 2014. While that means they have no “legacy” mortgage issues – bad loans left over from the mortgage crisis – they also have no performance metrics on their mortgage loans. In other words, there is no measurable statistic that currently states whether or not the SoFi home loans will be paid on time and consistently by all (or the majority) of borrowers who obtained them. The negative possibilities surrounding this may include:

Since there is no seasoning and reporting on loan performance, SoFi will have to hold and service their loans for some time. With thin margins and the expense of servicing regulations and staff, that could reduce the “normal” profitability derived from closing home loans.

Annemaria Allen with The Compliance Group stated earlier this year "And, in fact, the cost to service a loan continues to rise. According to Mortgage Bankers Association's Servicing Operations Study and Forum (SOSF), prior to the credit crisis it typically cost servicers an average of $55 per loan per year. Today experts estimate the cost to service at $208 per loan per year or more.”

The fact that very few members of the SoFi leadership team has direct previous experience in weathering mortgage seasonality, scalability, trends and economic impacts may also affect long term performance.

Pushback from Mortgage Industry “Leaders”

The fact that very few members of the SoFi leadership team has direct previous experience in weathering mortgage seasonality, scalability, trends and economic impacts may also affect long term performance.

Peter Cohan wrote in Forbes “5 Ways That Sofi Threatens Bank of America” and “Why SoFi Will Take Mortgage Market Share from Wells Fargo and JPMorgan Chase” delineating reasons and ways that SoFi could take business from the big banks, including: 1. Market segmentation; 2. Lower loan rates; 3. Higher deposit rates; Better customer experience; and more rapid response to change.

Why is all this in the "con" category? Think David and Goliath. And read more about the profitable future effects of regulations on SoFi an related companies HERE.

Will SoFi significantly change the complexion of the mortgage industry and, if so, when? In 2016, SoFi expects to close up to $3 billion in mortgages, including interest-only loans and loans that can be sold to Fannie Mae and Freddie Mac, according to Mike Cagney, co-founder and chief executive of Social Finance Inc. While those numbers currently pale in comparison to Bank of America, Chase, and Wells Fargo, they are at least mildly, err, disruptive.